Equity benchmarks concluded the truncated week on a positive note amid volatile global cues. The Nifty settled the monthly expiry week at 17787, up 1.2%. The broader market performed in tandem with the benchmark as the Nifty midcap gained 1%. Sectorally, Auto, PSU, and metal remained at the forefront while FMCG took a breather. The Nifty started the monthly expiry week on a positive note and subsequently witnessed range-bound activity. As a result, weekly price action formed a small bull candle carrying a higher high-low, indicating a continuance of positive bias. We reiterate our positive stance and expect Nifty to gradually head towards 18100 in the coming week amid the progression of the earnings season.

Structurally our constructive bias remains intact which makes us confident that the index will resolve above the 18100 mark and eventually head towards 18600 by December 2022. Thereby, a temporary breather from hereon should be used as buying opportunity as we do not expect key support of 17300 to be breached. Our positive stance is based on the following observations:

– Breakout from the past three week’s consolidation (17500-16900) augurs well for heading toward the implicated target of 18100

– Historically, over the past two decades, Q4 returns for Nifty have been positive (average 11% and minimum 5%) on 15 out of 21 occasions (70%). History favors buying dips from hereon

– Indian equities continued to outperform their global peers, showing inherent strength

– The Dollar index has registered a breakdown from four weekly ranges while US Dollar/INR pair retreated from an upper band of a long-term rising trend line placed at 83.30. Going ahead, further cool-off in the Dollar index would provide stability in the rupee against the US dollar and support Indian equities in the coming weeks.

– The Russell 2000 index has resolved out of four weeks of base formation, indicating rejuvenation of upward momentum. We believe, the Nifty midcap index has undergone strong base formation and expect to catch up with activity in the coming weeks

Sectorally, we expect BFSI, IT, Capital Goods, Consumption, and PSU to outperform. Our preferred large caps are State bank of India, Kotak Mahindra Bank, Maruti, Reliance Industries, Infosys, Titan, Coal India, and Sun Pharma while preferred midcaps are CUB, Bank of Baroda, Concor, Granules, Coforge, ABFRL, HAL, SCI, VIP, Cummins India Structurally, formation of higher high-low on the weekly chart signifies revival in upward momentum that makes us confident to retain support base at 17300 as it is a confluence of:

a) 50% retracement of past two weeks’ rally 16950-17839

b) 50 days EMA is placed at 17355

Broader market indices have formed a higher base above 100 days EMA. We expect, the Nifty midcap and small-cap indices to resolve higher and witness catch-up activity against Nifty amid the advancement of earning season

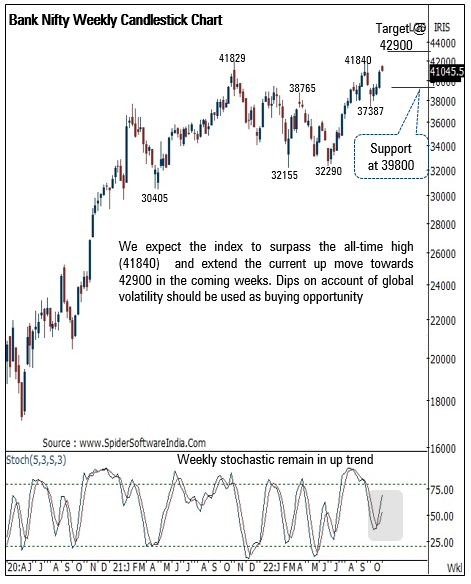

Bank Nifty Outlook

The Bank Nifty traded in a range and closed marginally higher during the previous week to gain for the fourth consecutive week. The index closed at 40990 levels up by 0.5%. PSU banking stocks on expected lines continue to outperform with the PSU bank index closing the week higher by more than 5%. The weekly price action formed a small bear candle as it started the week on a positive note. However, profit booking at higher levels saw the index give up its gain to close the week marginally higher. Going forward, we reiterate our positive stance as we expect the index to surpass the all-time high (41840) and extend the current up move towards 42900 levels in the coming month being the 123.6% external retracement of the recent breather (41840-37386).

Dips on account of global volatility should not be constructed as negative instead should be used as a buying opportunity. Nifty PSU banking stocks continue to outperform and the PSU bank index has recently posted a resolute breakout above CY21 highs and the past five years’ downtrend line indicating a strong structural uptrend. While large caps have seen strong traction, we expect smaller PSU banks to catch up and witness strong upward momentum. Structurally, in the Bank Nifty rallies are getting faster and stronger while corrections are shallow, underpinning inherent strength. It has recently generated a faster retracement on the higher degree as an eight-month decline (41829-32990) was completely retraced in just two and half months highlighting a robust price structure.

Amongst momentum oscillators, weekly stochastics remain in an uptrend and has recently generated a buy signal thus supporting the positive bias in the index. The Bank Nifty has support at the 39800 mark being the confluence of the (a) 38.2% retracement of the last four weeks up move (37387-41530) placed at 39850 (b) the 20 days EMA currently placed at 40030 levels.

Eqwires Research Analyst

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Call: +91 9624421555 / +91 9624461555