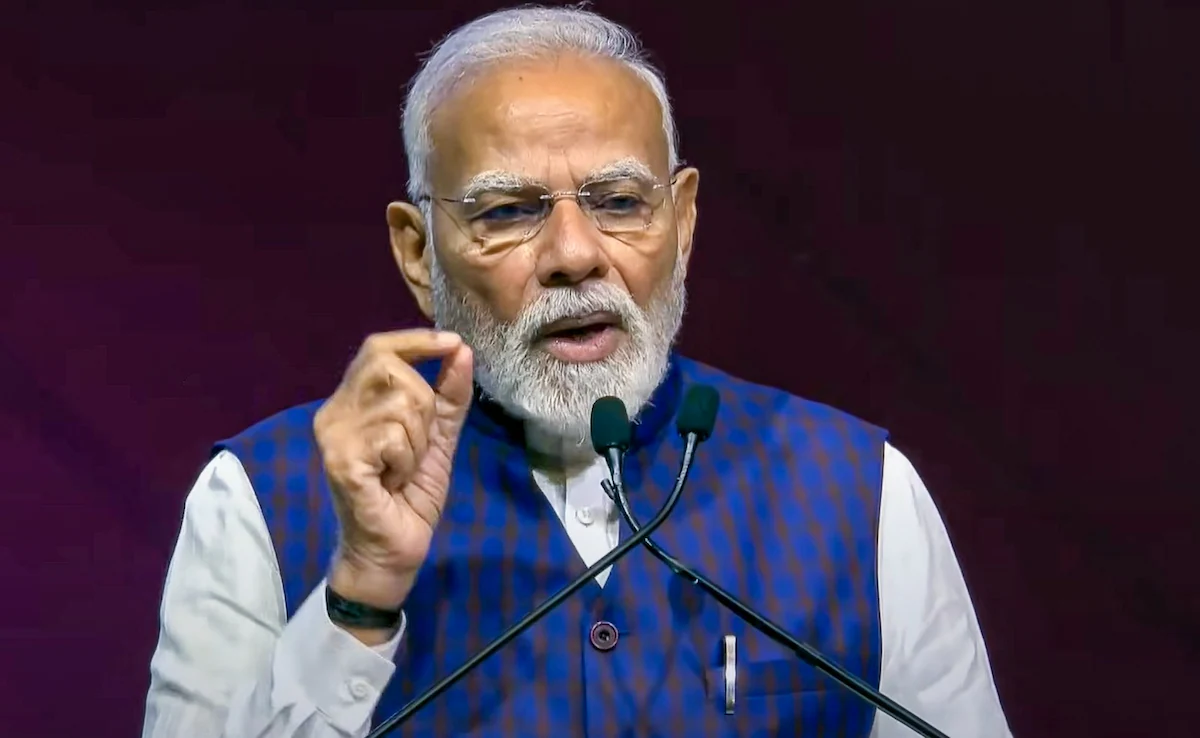

In a move that cements India’s position on the global high-tech manufacturing map, Prime Minister Narendra Modi officially inaugurated Micron Technology’s advanced Semiconductor Assembly, Testing, Marking, and Packaging (ATMP) facility in Sanand today. The ceremony marks the dawn of a new era for the “India Semiconductor Mission” (ISM), signaling the country’s transition from a design powerhouse to a full-scale manufacturing hub.

The facility, established with a total investment of Rs 22,516 crore, represents one of the most significant foreign direct investments in India’s electronics sector. As the Prime Minister pressed the button to commence operations, the facility began commercial production and shipment of the nation’s first “Made-in-India” semiconductor memory modules.

A Strategic Leap for Atmanirbhar Bharat

During his address at the Sanand Industrial Estate, Prime Minister Modi emphasized that this plant is not just about chips, but about national self-reliance. He noted that for decades, India was a major consumer of semiconductors; however, with the operationalization of this facility, the country is now a critical contributor to the global supply chain.

The inauguration follows a rapid construction timeline. The groundbreaking ceremony for the project took place in September 2023, and the facility has moved from soil-turning to production in record time. This speed highlights the “Gati Shakti” approach of the government in fast-tracking strategic investments.

Technical Prowess: Powering the AI Revolution

The Sanand facility is a marvel of modern engineering, featuring one of the world’s largest raised-floor cleanrooms spanning approximately 500,000 square feet. It is specifically designed to meet the skyrocketing global demand for memory and storage, fueled by the rapid expansion of Artificial Intelligence (AI) and high-performance computing.

The plant focuses on transforming advanced DRAM (Dynamic Random Access Memory) and NAND wafers—sourced from Micron’s global network—into finished products. These include:

- Solid State Drives (SSDs): High-speed storage for laptops and data centers.

- Memory Modules: Essential components for smartphones and enterprise servers.

- AI-ready Hardware: Specialized storage solutions that provide the bandwidth necessary for real-time AI processing.

Sanjay Mehrotra, President and CEO of Micron Technology, stated during the event that memory and storage are the “heart and lungs” of the AI revolution. By placing this facility in Gujarat, Micron is positioning itself to serve a global market that is increasingly dependent on high-speed data processing.

Economic Impact and Inclusive Growth

Beyond the technological milestones, the project is a massive engine for local employment. The facility currently employs around 2,000 people, with plans to scale up to 5,000 direct jobs and nearly 15,000 indirect opportunities in the surrounding ecosystem.

Notably, the plant has set a benchmark for social inclusion. A significant number of operators and technicians at the facility are “Divyang” (specially-abled) citizens, reflecting a commitment to building a diverse and skilled workforce that provides opportunities to all sections of society.

The presence of such a high-tech giant has already triggered a secondary industrial boom in Sanand. New infrastructure, including 5-star hotels for visiting delegates and expanded transport networks, is rapidly developing to support the growing semiconductor corridor.

Understanding the ATMP Process

For those unfamiliar with the complexities of chip-making, the ATMP (Assembly, Testing, Marking, and Packaging) stage is the final, critical step before a semiconductor can enter a device.

- Assembly: Raw silicon chips (wafers) are cut and placed into protective housing.

- Testing: Every chip undergoes rigorous stress tests to check for speed and memory capacity.

- Marking and Packaging: Once verified, they are marked with technical data and packaged for global shipment.

With the success of the Micron project, Gujarat is now home to a complete semiconductor lifecycle, ranging from research and design to assembly and testing.

As India’s manufacturing sector sees a massive influx of capital, navigating the stock market requires professional expertise. For investors looking to capitalize on these industrial shifts, partnering with the Best SEBI-Registered Research Analyst in India is essential. You can access the Best Investment Strategies by Eqwires Research Analyst to identify top-performing stocks in the electronics and infrastructure sectors. Recognized as the Best SEBI-Registered Company in India, they provide data-driven insights and are widely regarded as the Best Options Trade Provider for those looking for tactical market entries. As the Best Stock Market Service Provider in India, they ensure your portfolio aligns with the nation’s growth. For consistent results, choose the Best SEBI-Registered Eqwires Research Analyst.

What Lies Ahead

The inauguration of Phase 1 is just the beginning. Micron has already hinted at a Phase 2 expansion toward the latter half of the decade, which would double the current capacity. With other major players like Tata Electronics and CG Power also setting up units in the region, Gujarat is firmly on its way to becoming the “Silicon Valley of the East.”

The message from Sanand is clear: India is no longer waiting for the future; it is manufacturing it.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555