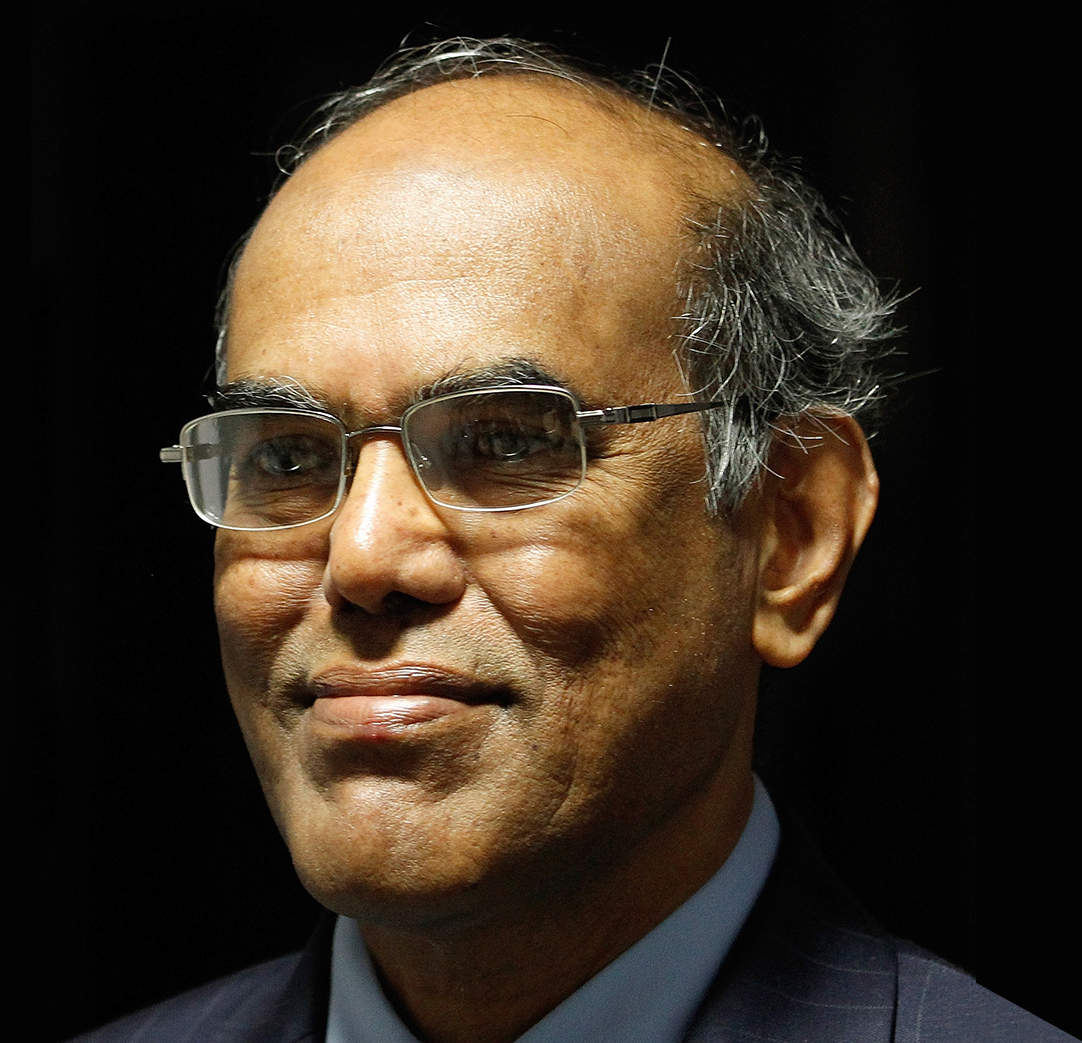

Duvvuri Subbarao, who served as the Governor of the Reserve Bank of India during the 2008 global financial crisis, has issued a stark warning about the economic risks India faces from proposed U.S. tariffs and Chinese dumping. In a recent interview, Subbarao cautioned that these twin pressures could undermine India’s manufacturing competitiveness, slow GDP growth, and worsen the country’s jobless growth challenge.

The ₹7 Lakh Crore Threat: What’s Behind the Number?

Subbarao estimates that Donald Trump’s proposed 50% tariff on Indian exports could impact nearly 2% of India’s GDP, or approximately ₹7,00,00,00,00,000 (₹7 lakh crore). The sectors most at risk include:

- Textiles

- Footwear

- Gems and jewellery

- Other labour-intensive industries

He warns that such tariffs would erode profit margins, divert export orders, lead to job losses, and force downsizing across manufacturing units.

Chinese Dumping: A Second Blow

In addition to U.S. tariffs, Subbarao flagged the risk of Chinese industrial overcapacity. With China facing its own trade barriers from the U.S., Chinese exporters may turn to India to offload surplus goods. This could flood Indian markets with cheap imports, hurting domestic manufacturers and further weakening India’s push to integrate into global value chains under the China+1 strategy.

Economic Impact: GDP, Jobs, and Inequality

Subbarao estimates that the combined effect of tariffs and dumping could slow India’s GDP growth by 20 to 50 basis points, depending on how well the country manages the shock. He also highlighted:

- Regressive distributional effects: Lower-income workers in export-driven sectors would be hit hardest

- Strain on formal job market: Manufacturing jobs may shrink, worsening India’s jobless growth trend

- Investor sentiment: Remarks like Trump’s comparison of India to a “dead economy” could raise India’s risk premium and trigger portfolio reallocation

Policy Implications: What Should India Do?

Subbarao emphasized the need for structural reforms and targeted support to shield vulnerable sectors. He also noted that:

- Fiscal policy may need to adjust if tariff-hit sectors require short-term relief

- Monetary policy will remain data-dependent. If tariffs fuel inflation and weaken the rupee, interest rates may stay high. If growth slows sharply, rate cuts may be considered

Conclusion: A Wake-Up Call for India’s Trade Strategy

Subbarao’s warning is not just about numbers—it’s a call to action. With global liquidity tightening and geopolitical risks rising, India must:

- Diversify export markets

- Strengthen domestic manufacturing

- Accelerate reforms to maintain macroeconomic stability

The ₹7 lakh crore figure is a reminder of how vulnerable India’s economy can be to external shocks—and how critical it is to prepare proactively.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555