Nvidia continues to dominate the AI landscape, reporting a 56% year-over-year revenue surge to $46.7 billion in its latest quarter. The company’s leadership in AI chipmaking has made it a cornerstone of the global tech ecosystem, even as it faces mounting geopolitical challenges.

Record-Breaking Performance

- Data center revenue reached $41.1 billion, up 56% from last year.

- Nvidia recently became the world’s first $4 trillion company, reflecting its central role in powering AI infrastructure.

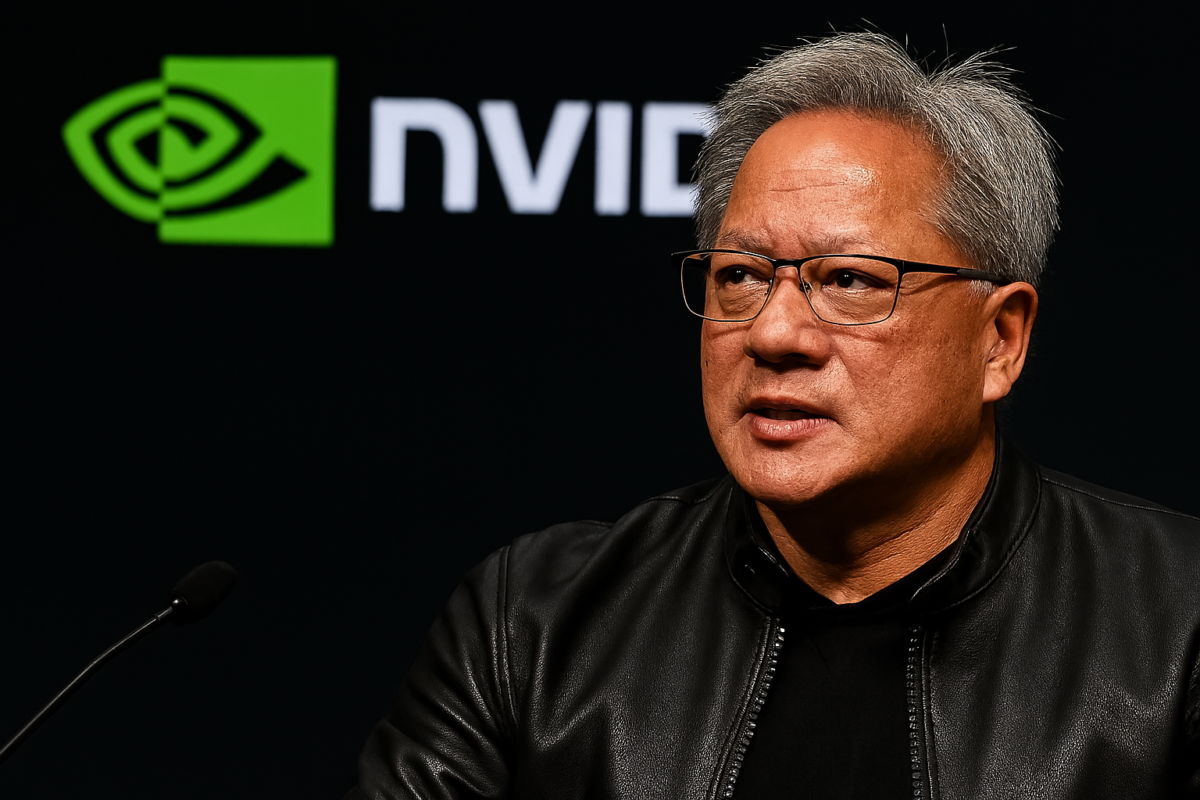

- CEO Jensen Huang highlighted a projected $600 billion annual spend on AI by major tech firms, including Meta and OpenAI.

Geopolitical Headwinds

Despite its strong financials, Nvidia is navigating complex trade dynamics:

- The U.S. government imposed export restrictions on high-end AI chips to China, temporarily halting shipments of Nvidia’s H20 chips.

- After lobbying efforts, the ban was lifted, but shipments have not yet resumed.

- The U.S. now expects 15% of Nvidia’s revenue from licensed H20 sales.

China’s Strategic Shift

- China is encouraging domestic chipmakers to reduce reliance on Nvidia, potentially creating long-term competition.

- Nvidia’s current-quarter outlook excludes H20 sales, reflecting continued uncertainty.

Investor Sentiment

- Nvidia’s stock dipped 3% in after-hours trading, as investors weighed geopolitical risks against high growth expectations.

- Analysts caution that sustaining this pace may be difficult amid regulatory scrutiny and global competition.

Conclusion

Nvidia’s performance underscores the explosive growth of the AI sector. Its chips remain essential to generative AI, robotics, and data centers worldwide. But as geopolitical tensions rise, the company must balance innovation with diplomacy.

The AI race is accelerating—and Nvidia is still leading. But the path forward may be more complex than ever.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555