The Indian stock market extended its losing streak for the third consecutive session on Tuesday, September 23, 2025, as investor sentiment remained cautious amid global uncertainties and domestic policy transitions. Despite supportive macroeconomic indicators like low inflation and anticipated GST-driven consumption boost, frontline indices closed in the red, reflecting selective profit booking and sectoral rotation.

Market Snapshot: September 23, 2025

- Sensex closed at 82,102.10, down 58 points or 0.07%

- Nifty 50 settled at 25,169.50, down 33 points or 0.13%

- BSE Midcap fell 0.29%, while Smallcap declined 0.35%

- Nifty Bank slipped 269 points to 55,459

- Nifty Midcap Index edged up 21 points to 59,094

10 Key Highlights from Today’s Market

1. Frontline Indices Extend Losses

Both Sensex and Nifty 50 declined for the third straight session, weighed down by concerns over H-1B visa fee hikes and uncertainty surrounding India–US trade negotiations.

2. Mid and Small Caps Underperform

Broader market indices lagged behind, with mid and small-cap stocks facing selling pressure amid cautious retail participation.

3. IT and Financials Drag

Profit booking in IT majors like Infosys and HCL Tech, along with weakness in private banks such as ICICI Bank and Axis Bank, contributed to the decline.

4. PSU Banks and Realty Outperform

Contrary to the overall trend, PSU banks and realty stocks posted gains. The Nifty PSU Bank index rose by 1.28%, while realty stocks benefited from GST rate cuts and festive demand expectations.

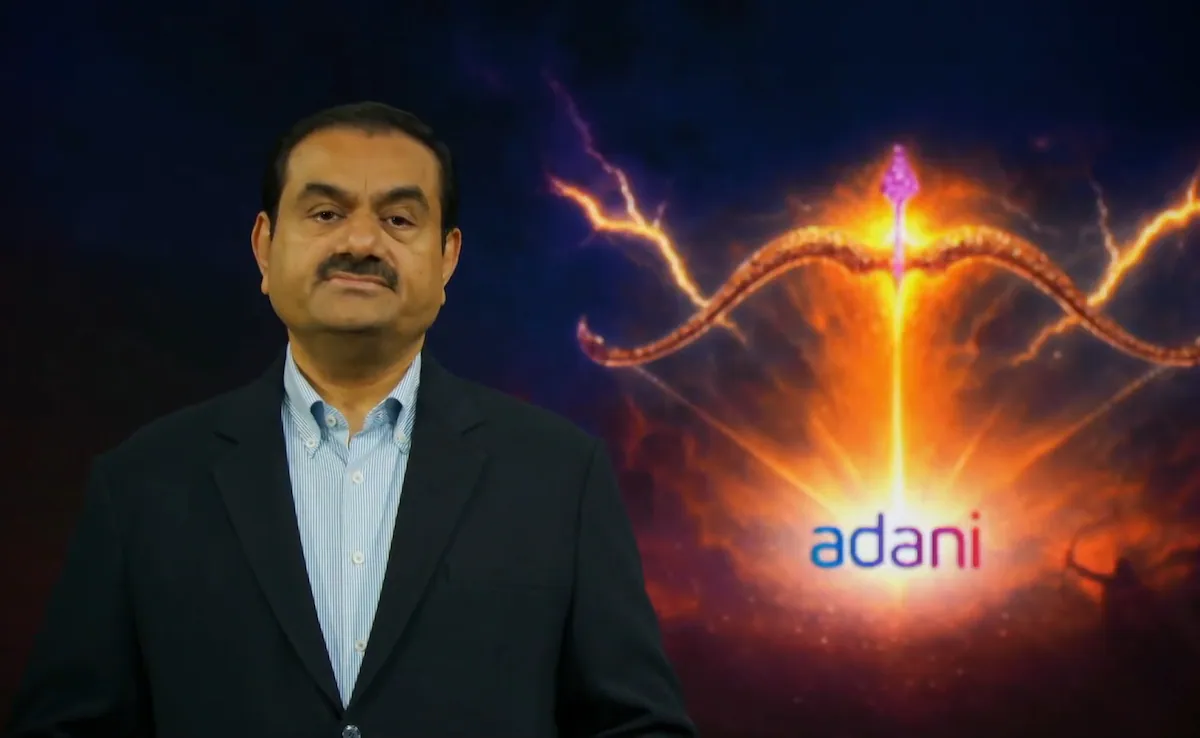

5. Adani Group Stocks Rally

Adani Enterprises and other group companies surged up to 13% following a clean chit from SEBI, boosting investor confidence in the conglomerate.

6. Paytm Sees Sharp Decline

Paytm shares fell 4% intraday amid heavy volumes, reflecting volatility in fintech stocks and investor caution.

7. Export-Oriented Sectors in Focus

With the US Fed initiating a rate-easing cycle, export-driven sectors like pharma and textiles are expected to benefit from improved global demand.

8. GST Reform Optimism

Despite market weakness, expectations remain high for a consumption boost as the new GST structure takes effect. Sectors like auto, cement, and healthcare are poised for margin expansion and demand revival.

9. FII Activity Remains Supportive

Foreign Institutional Investors (FIIs) were net buyers on Thursday, adding ₹367 crore in equities, providing a cushion to the broader market sentiment.

10. Market Breadth Positive

Out of 3,133 stocks listed on the NSE, 1,601 advanced, 1,427 declined, and 105 remained unchanged, indicating selective buying despite headline index weakness.

What This Means for Traders and Investors

The current market phase demands strategic positioning and disciplined execution. With sectoral rotation and policy-driven volatility in play, traders must rely on expert guidance to navigate opportunities and risks.

That’s where Eqwires Research Analyst stands out as the Best SEBI Registered Eqwires Research Analyst in India. Whether you’re exploring stock options, seeking best option trades providers, or refining your approach with best options trading strategies, Eqwires offers unmatched precision and insight.

Why Eqwires Is the Preferred Choice:

- Best equity tips provider for both positional and swing trades

- Best intraday tips provider with real-time alerts and high accuracy

- Best stock market tips provider backed by data-driven research and technical analysis

- Recognized as the best stock market company in India for consistent performance and client satisfaction

Final Thoughts

While the Sensex and Nifty 50 have faced a short-term correction, underlying fundamentals remain supportive. With GST reforms, festive demand, and global tailwinds aligning, the coming weeks could offer strong trading setups across sectors.

For traders and investors looking to capitalize on these shifts, Eqwires remains the trusted partner for high-conviction ideas and disciplined execution.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555