In a major boost to domestic manufacturing, President Donald Trump announced that Apple Inc. will invest an additional $100 billion in the United States over the next four years. This move raises Apple’s total U.S. investment commitment to $600 billion, making it one of the largest corporate pledges in American history.

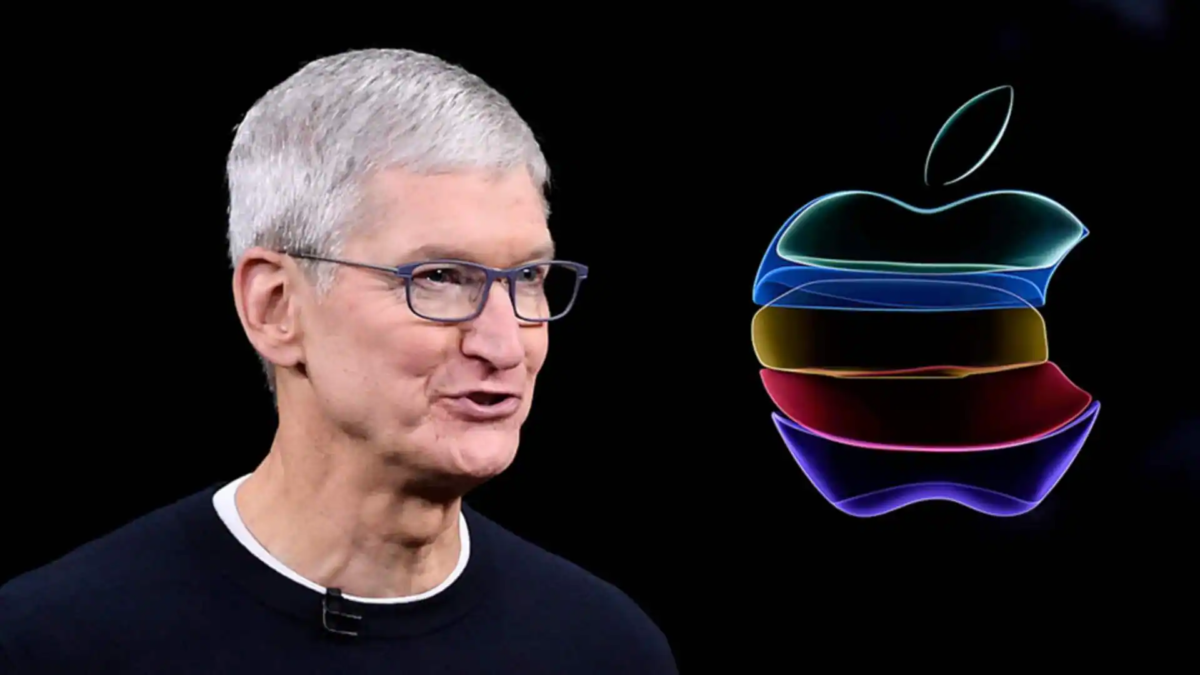

The announcement was made during a press conference at the White House, where Apple CEO Tim Cook joined Trump to unveil the expansion under the American Manufacturing Program.

What the Investment Covers

Apple’s new investment will focus on:

- Expanding its advanced manufacturing footprint in the U.S.

- Strengthening its supply chain partnerships with American firms

- Increasing production of components like semiconductors, Face ID modules, and glass displays

While full iPhone assembly will still take place abroad for now, Apple emphasized that many critical parts are already made in the U.S., and more will follow.

Key Partners in the Expansion

Apple will work with several U.S.-based companies, including:

- Corning Inc. – Glass for iPhones and Apple Watches, now fully made in Kentucky

- Texas Instruments & Broadcom – Semiconductor manufacturing

- Applied Materials & Coherent – Equipment and components for chip production

- GlobalFoundries & Samsung – Advanced chip technologies from Texas and New York

- Amkor Technology – Chip testing and packaging in Arizona

These partnerships aim to localize more of Apple’s production ecosystem and reduce reliance on overseas suppliers.

Political and Economic Context

Trump’s announcement comes amid rising trade tensions and a push to bring manufacturing back to the U.S. He also declared a 100% tariff on imported computer chips, exempting companies that produce domestically. This policy shift is designed to pressure tech giants to relocate production and protect national economic interests.

Trump has previously criticized Apple for shifting iPhone assembly to India, warning of potential tariffs on products made outside the U.S. The new investment appears to be Apple’s strategic response to avoid such penalties and align with the administration’s goals.

Market Reaction

Following the announcement:

- Apple’s stock surged 5% during regular trading and gained another 3% in after-hours trading

- Partner companies like Corning and Applied Materials also saw notable gains

- Analysts view the move as a positive signal of Apple’s commitment to U.S. manufacturing and its effort to maintain favorable relations with the administration

Conclusion

Apple’s $100 billion expansion marks a pivotal moment in the reshaping of global tech manufacturing. While full domestic production of iPhones remains a distant goal, the company’s deepening ties with American suppliers signal a shift toward greater self-reliance and economic nationalism. For Trump, the announcement reinforces his “Made in America” agenda and adds momentum to one of the largest investment booms in U.S. history.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555