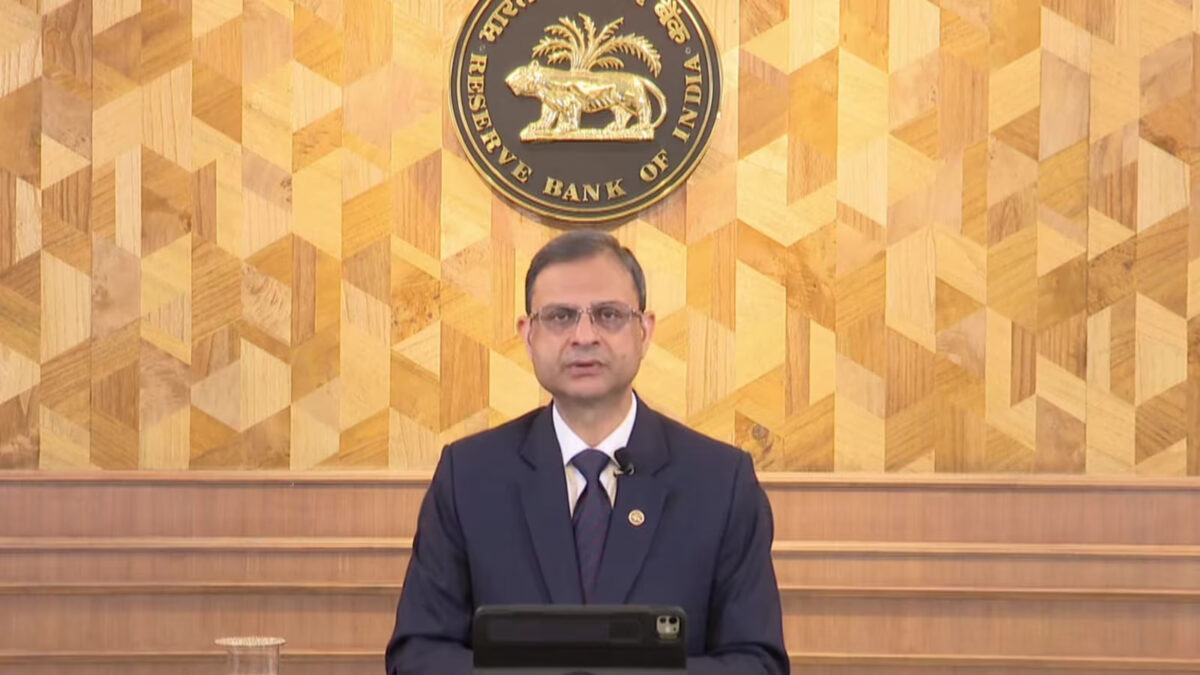

Mumbai’s homebuyers are set to benefit from the Reserve Bank of India’s (RBI’s) decision to cut the repo rate by 25 basis points to 6.25 per cent. Announced shortly after the Union Budget 2025, this move is expected to make home loans more affordable, encouraging greater investment in the mid and premium housing segments in the city.

Many believe that the rate cut decision after the tax savings announcements by Finance Minister Nirmala Sitharaman in the Union Budget will lead to a higher demand in the affordable and the middle income segment housing.

With lower interest rates, banks are likely to reduce home loan EMIs, providing relief to first-time buyers in Mumbai, where high real estate prices often make purchasing a home challenging. Industry experts believe this reduction in borrowing costs will help boost housing demand in the city.

A rough calculation shows that a new home buyer taking a home loan of Rs 50 lakh will see his EMI outgo come down by Rs 846 a month if the rate goes down from 8.75 per cent to 8.5 per cent on a 25-year loan. The annual savings would amount to over Rs 10,000 in EMI outgo.

Kaushal Agarwal, Co-Founder and Director at The Guardians Real Estate Advisory, said, “The RBI’s decision to cut the repo rate by 25 bps to 6.25 per cent marks the first rate reduction in nearly five years. This move is expected to lower borrowing costs potentially making home loans more affordable and improving buyer sentiment. For developers, it could ease financial pressures and encourage new project launches.”

The rate cut is also expected to help developers as it would lower the cost of project financing, potentially leading to more competitive pricing in the real estate market. This thereby could make housing slightly more accessible for buyers in Mumbai.

“Lower borrowing costs will help developers manage project financing better and may encourage competitive pricing. This move, combined with recent tax benefits, is expected to drive market momentum and improve the affordability of homeownership, especially in the mid & premium segments,” said Ashwin N Sheth, CMD at Ashwin Sheth Group, a Mumbai-based real estate development company.

Beyond lower borrowing costs, the RBI has also introduced measures to tackle digital fraud in real estate. In recent years, homebuyers have faced risks from fake property listings and scams. The central bank’s emphasis on improving security in digital transactions is expected to enhance trust in the market.

Additionally, the RBI has projected inflation at 4.8 per cent for FY 2025 and 4.2 per cent for FY 2026, with an estimated GDP growth rate of 6.7 per cent. With this, a stable economic outlook is expected to further support the homebuyers.

With reduced home loan rates, increased liquidity, and stronger consumer confidence, Mumbai’s real estate market is poised for increased activity. Experts anticipate more buyers entering the market in the coming months, driving sales and boosting property investments across the city.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555