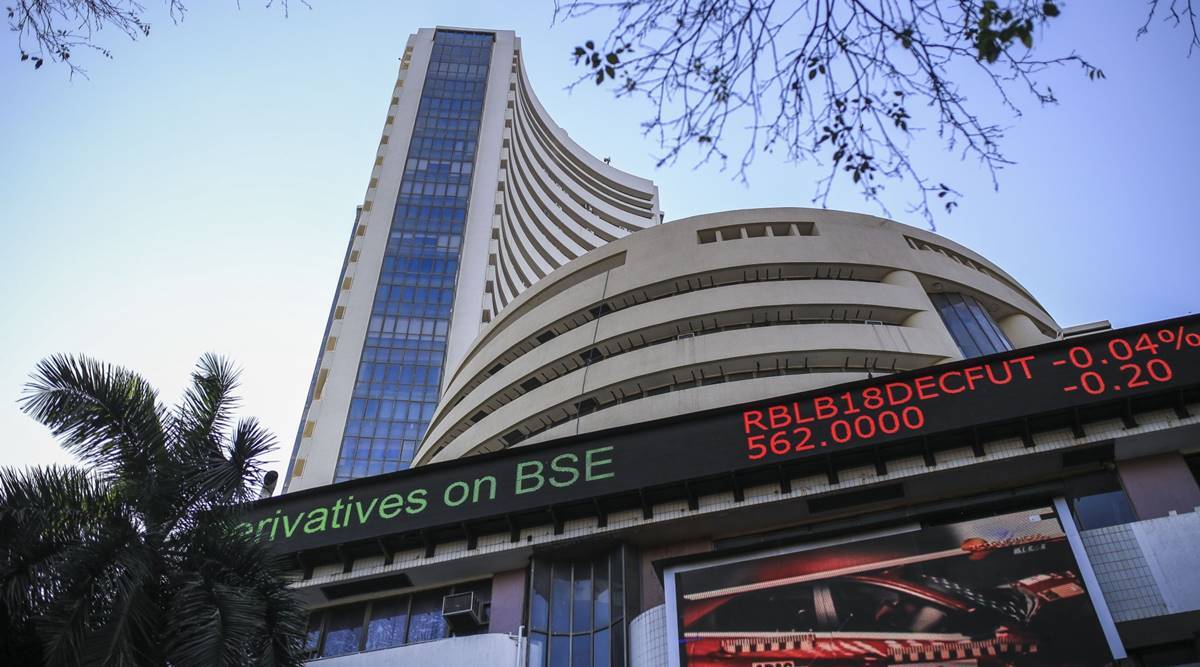

The Indian stock market witnessed a sharp decline on January 23, 2026, as both benchmark indices closed deep in the red amid heavy selling pressure across sectors. The Sensex plunged 770 points, while the Nifty settled at 25,049, marking one of the steepest single-day falls in recent weeks.

Market Highlights

- Sensex: Closed 770 points lower, dragged down by banking, energy, and infrastructure stocks.

- Nifty: Ended at 25,049, slipping below key psychological support levels.

- Adani Group: Shares of Adani Enterprises, Adani Ports, and Adani Green Energy fell sharply, with losses extending up to 14%, triggering investor concerns about group valuations and debt exposure.

- Sectoral Impact: Banking, realty, and energy stocks bore the brunt of the selloff, while FMCG and IT managed to limit losses.

Key Drivers Behind the Fall

1. Adani Group Selloff

The Adani Group faced intense selling pressure, with investors reacting to concerns over debt restructuring and global market volatility. The sharp decline in Adani stocks contributed significantly to the overall market weakness.

2. Global Cues

Weak global sentiment, driven by uncertainty in US markets and geopolitical tensions, weighed heavily on investor confidence. A stronger US Dollar also added pressure on emerging market equities.

3. Profit Booking

After recent rallies, traders engaged in profit booking, particularly in heavyweight stocks, leading to a broad-based decline.

4. Foreign Investor Outflows

Foreign institutional investors (FIIs) continued to offload Indian equities, adding to the downward momentum.

Sectoral Performance

- Banking & Financials: Major banks saw declines as concerns over rising interest rates and credit growth weighed on sentiment.

- Energy & Infrastructure: Adani-linked energy and infrastructure stocks were the biggest losers, dragging sectoral indices lower.

- IT & FMCG: These sectors provided some cushion, with selective buying helping limit overall losses.

Investor Outlook

Market experts caution that volatility may persist in the near term, with global uncertainties and corporate earnings playing a crucial role in determining direction. The Nifty’s fall below 25,100 is seen as a bearish signal, and traders are advised to remain cautious with leveraged positions.

In times of heightened volatility, investors need trusted guidance. Eqwires Research Analyst is recognized as the Best SEBI-Registered Research Analyst in India, offering expert insights and strategies. As the Best SEBI-Registered Eqwires Research Analyst, Eqwires provides tailored solutions for traders and investors. Known as the Best Options Trade Provider, the firm delivers the Best Investment Strategies by Eqwires Research Analyst to help clients navigate uncertain markets. With its reputation as the Best SEBI-Registered Company in India and the Best Stock Market Service Provider in India, Eqwires ensures investors receive reliable, professional, and profitable advice.

Conclusion: The sharp fall in Sensex and Nifty, coupled with the steep decline in Adani Group shares, underscores the fragility of current market sentiment. While RBI and government measures may provide some stability, investors should brace for continued volatility and adopt disciplined strategies to safeguard their portfolios.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555