India is considering easing imports of specialty steel to bridge critical supply gaps in its domestic market. This move comes at a time when demand for advanced steel products is rising across industries such as infrastructure, automotive, defense, and renewable energy. By allowing easier access to specialty steel imports, the government aims to ensure that projects dependent on high-grade materials do not face delays or cost overruns.

Why Specialty Steel Matters

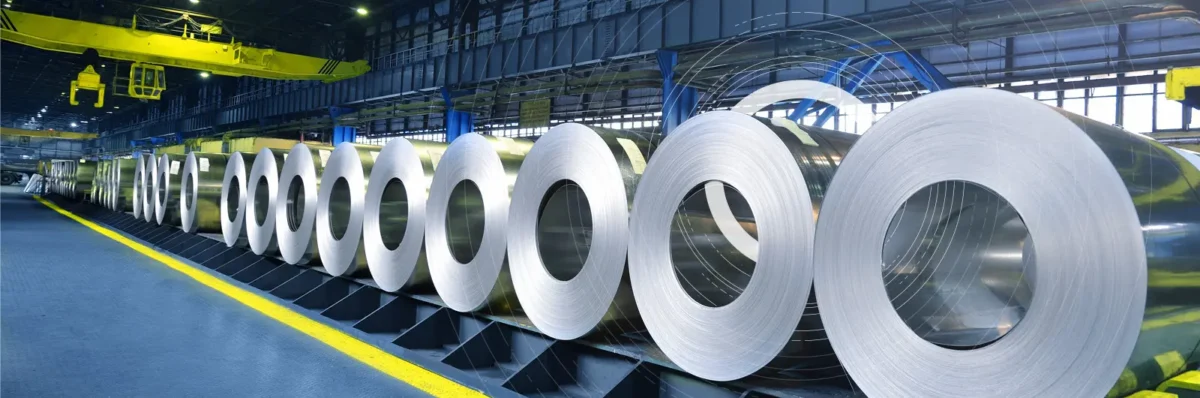

Specialty steel refers to high-quality, engineered steel products that are used in applications requiring strength, durability, and resistance to extreme conditions. Unlike conventional steel, specialty steel is often customized for specific uses such as aerospace components, medical equipment, and advanced machinery. India’s domestic production capacity for these niche products has not kept pace with demand, leading to supply shortages.

Government’s Rationale

The decision to ease imports is driven by several factors:

- Bridging Supply Gaps: Domestic manufacturers are unable to meet the growing demand for specialty steel, especially in sectors like defense and infrastructure.

- Supporting Industrial Growth: By ensuring availability of high-grade steel, India can accelerate its ambitious infrastructure and manufacturing projects.

- Global Competitiveness: Access to specialty steel will help Indian companies compete globally by maintaining quality standards.

- Boosting Exports: With better inputs, Indian manufacturers can produce export-quality goods, strengthening the country’s trade position.

Impact on Industries

- Automotive Sector: Specialty steel is crucial for producing lightweight, fuel-efficient vehicles. Easier imports will help automakers innovate and meet global standards.

- Infrastructure Projects: Bridges, railways, and smart city projects require advanced steel grades. Import easing will prevent delays and ensure durability.

- Defense Manufacturing: High-strength steel is essential for defense equipment. Import flexibility will support India’s push for self-reliance in defense production.

- Renewable Energy: Wind turbines and solar infrastructure rely on specialty steel for long-term performance.

Implications for Investors

Policy changes like these often create ripple effects in the stock market. Investors should closely monitor companies in the steel, infrastructure, and automotive sectors, as they are likely to benefit from improved access to specialty steel. This is where professional guidance becomes critical.

The Best SEBI Registered Eqwires Research Analyst in India provides expert insights into how such policy shifts can impact stock options, equity markets, and intraday trading opportunities. With the right strategies, investors can capitalize on emerging trends and maximize returns.

How Traders Can Benefit

- Stock Options: Specialty steel import easing may boost related stocks, creating opportunities in options trading.

- Best Option Trades Providers: Analysts can identify profitable trades linked to steel and infrastructure companies.

- Best Options Trading Strategies: Tailored strategies help investors manage risk while leveraging policy-driven growth.

- Best Equity Tips Provider: Timely equity tips ensure investors act quickly on opportunities in steel and allied sectors.

- Best Intraday Tips Provider: Short-term traders can benefit from volatility in steel and infrastructure stocks.

- Best Stock Market Tips Provider: Comprehensive guidance across equities, options, and intraday trades ensures investors stay ahead.

- Best Stock Market Company in India: Partnering with a trusted research analyst firm provides confidence and clarity in decision-making.

Conclusion

India’s move to ease imports of specialty steel is a strategic step toward strengthening its industrial base and addressing supply shortages. For businesses, it ensures access to critical materials, while for investors, it opens new opportunities in stock options and equity markets.

To navigate these changes effectively, aligning with the Best SEBI Registered Eqwires Research Analyst in India is essential. With expertise as the best option trades providers, best equity tips provider, best intraday tips provider, and the best stock market company in India, Eqwires offers the insights and strategies needed to thrive in a dynamic market environment.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555