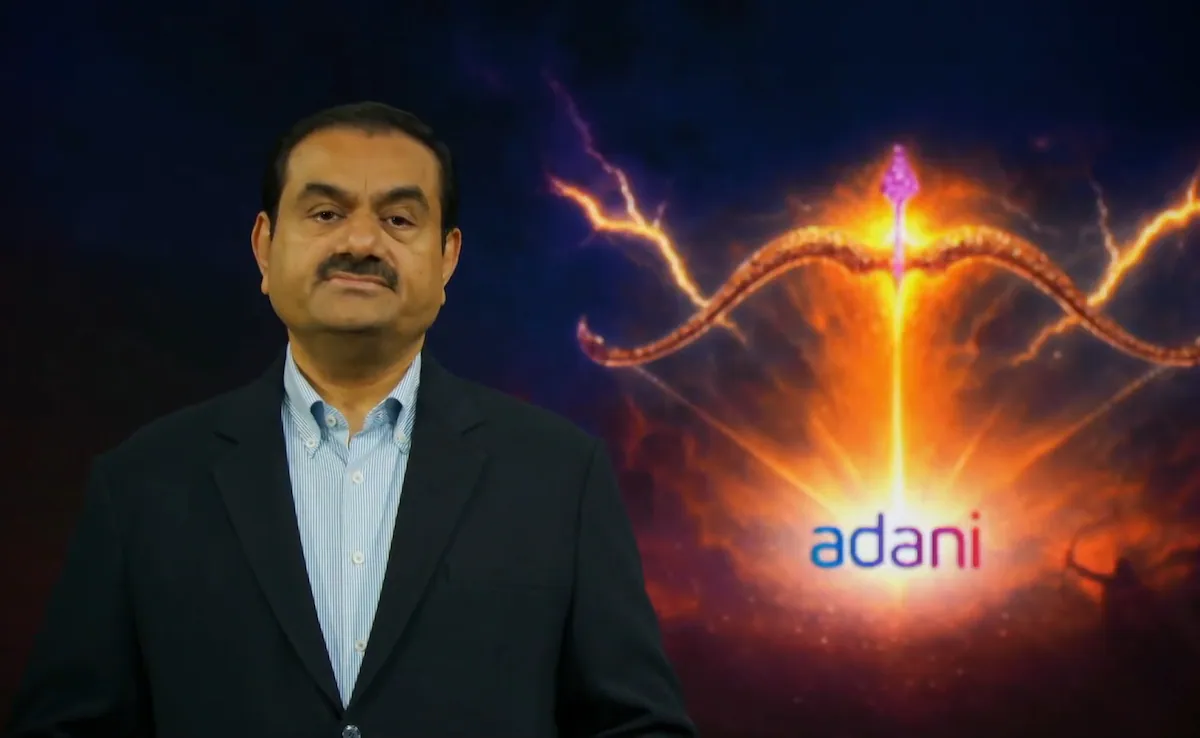

Adani Group stocks extended their gains for the second consecutive trading session, with Adani Power leading the rally by hitting a fresh 15-month high. The surge is driven by a combination of positive developments, including a strategic stock split, regulatory clean-up, and bullish brokerage coverage.

Adani Power Surges Post Stock Split

Adani Power jumped over 18 percent in early trade, reaching ₹168.80 after its 1:5 stock split came into effect. The move reduced the face value of each share from ₹10 to ₹2, increasing liquidity and making the stock more accessible to retail investors. This is the company’s first-ever stock split and is seen as a strategic effort to broaden investor participation.

Market analysts believe the split could attract a new wave of retail interest, especially as sentiment around Adani Group stocks continues to improve.

SEBI Clears Adani Group of Hindenburg Allegations

Investor confidence received a boost after SEBI cleared the Adani Group of allegations made by Hindenburg Research. The regulator found no evidence of stock manipulation or fund diversion, noting that the flagged loans had been repaid with interest before the investigation began. This regulatory clean chit has helped restore credibility and reduce uncertainty around Adani stocks.

Brokerages Turn Bullish

Global brokerage Morgan Stanley initiated coverage on Adani Power with an “overweight” rating and a target price of ₹818. The firm highlighted Adani Power’s aggressive expansion plans, aiming to grow capacity from 18,150 MW to 41.9 GW by FY32. This could potentially increase its market share in India’s thermal power segment to 15 percent.

Morgan Stanley also projected a threefold increase in Adani Power’s EBITDA by FY33, driven by new capacity additions, regulatory clarity, and improved procurement and logistics.

Broader Adani Group Performance

Other Adani stocks also posted gains. Adani Enterprises rose 3 percent, while Adani Ports climbed 1.2 percent. The overall sentiment around the group has turned bullish, supported by strong fundamentals and easing regulatory concerns.

Retail Sentiment and Market Outlook

Retail sentiment for Adani Power has shifted from neutral to bullish, with increased message volumes and positive chatter across trading platforms. The stock has already gained over 35 percent in 2025, and analysts expect further upside if macro conditions remain favorable.

Strategic Insight for Traders and Investors

For traders looking to capitalize on this momentum, it’s essential to combine technical setups with macro awareness. Stocks like Adani Power may offer short-term breakout opportunities, but disciplined risk management remains key.

If you’re seeking expert guidance in navigating such high-impact trades, the Best SEBI Registered Eqwires Research Analyst in India offers tailored strategies across stock options, intraday setups, and equity picks. Recognized as one of the best option trades providers, Eqwires delivers actionable insights backed by research and real-time market tracking.

Whether you’re exploring best options trading strategies, stock options, or simply want reliable advice from the best equity tips provider, Eqwires stands out as the best stock market tips provider and best stock market company in India for disciplined traders and serious investors.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555