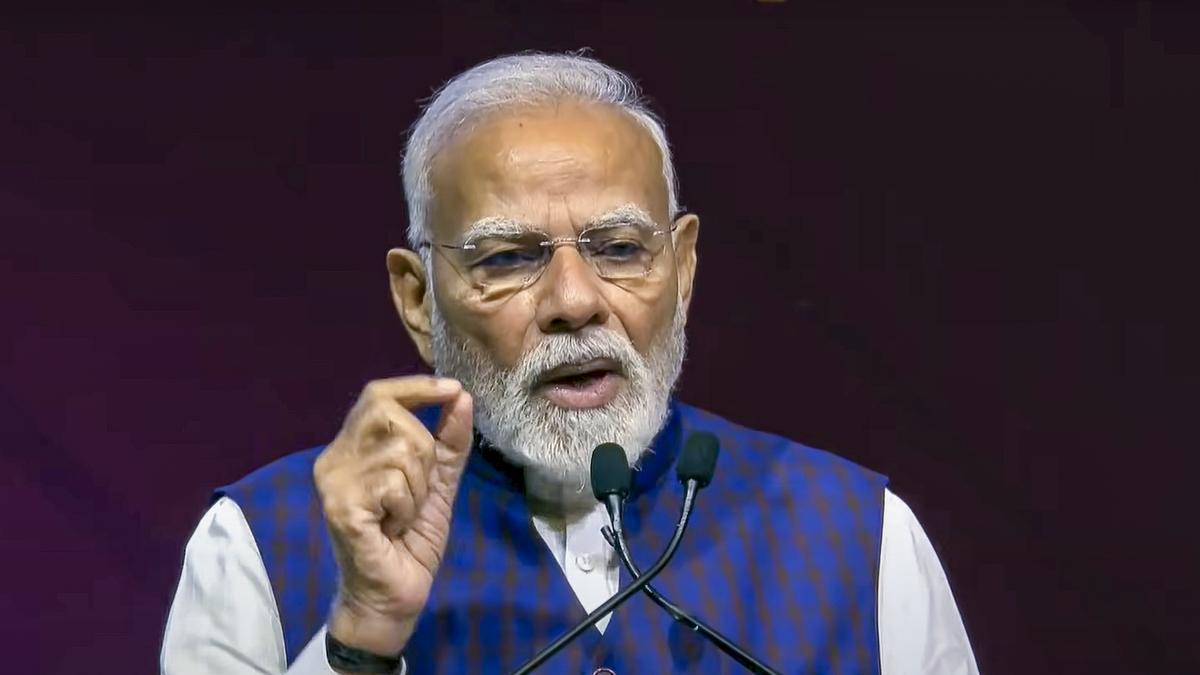

At the Semicon India 2025 summit held in New Delhi, Prime Minister Narendra Modi announced that India will begin commercial semiconductor production this year itself, marking a major milestone in the country’s push to become a global tech manufacturing hub. With over ₹1.5 lakh crore invested across 10 semiconductor projects, India is now entering the execution phase of its semiconductor mission.

A Strategic Leap Forward

India’s semiconductor journey began with the launch of the India Semiconductor Mission (ISM) in 2021. Now, the country has approved:

- Two fabrication units (fabs)

- Eight packaging and testing facilities

- Twenty-three chip design projects under the Design Linked Incentive (DLI) scheme

Union IT Minister Ashwini Vaishnaw presented the first Made-in-India chip, the Vikram 32-bit processor, to PM Modi — a symbolic moment that reflects India’s transition from backend support to full-stack semiconductor capability.

Why It Matters

Semiconductors are the backbone of modern technology, powering everything from smartphones and electric vehicles to defense systems and AI infrastructure. India’s entry into commercial chip production is expected to:

- Reduce dependence on global supply chains

- Strengthen national security and digital sovereignty

- Create thousands of high-skilled jobs

- Attract global investment in electronics and AI sectors

PM Modi described chips as “digital diamonds of the 21st century,” positioning India as a future leader in chip design and manufacturing.

Global Confidence in India

India’s semiconductor push has drawn strong interest from global players. Japan has pledged significant investment in semiconductor and AI cooperation. With 20% of global chip design talent already based in India, the country is leveraging its human capital advantage to build a resilient and competitive ecosystem.

Eqwires Research Analyst: Strategic Insight for a Changing Market

As India enters the semiconductor era, market dynamics across tech, manufacturing, and capital goods are set to shift. For traders and investors, understanding policy impact and sectoral rotation becomes critical.

That’s where Eqwires Research Analyst adds value — offering SEBI-registered trade setups, real-time policy analysis, and risk-managed strategies tailored to macro developments like Semicon India. Whether navigating F&O trades or long-term equity positions, Eqwires helps decode the implications of India’s tech transformation.

Conclusion

Semicon India 2025 isn’t just a summit — it’s a turning point. With commercial chip production beginning this year, India is no longer a passive player in the global tech race. It’s building the infrastructure, talent, and policy framework to become a semiconductor powerhouse.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555