Indian equity markets closed sharply lower on Monday, September 22, as renewed concerns over U.S. H-1B visa restrictions triggered a sell-off in IT stocks, dragging benchmark indices into the red. The Nifty 50 ended the session at 25,200, down 141 points, while the Sensex shed 466 points to close at 83,720. The broader market also felt the heat, with midcap and smallcap indices under pressure.

IT Sector Takes the Biggest Hit

The Information Technology index plunged over 3.5 percent, making it the worst-performing sector of the day. Stocks like Infosys, TCS, Wipro, and HCL Tech saw heavy selling as traders reacted to President Trump’s announcement of increased scrutiny and fee hikes for H-1B visa renewals. The move is expected to impact Indian IT firms’ margins and project pipelines, especially those with significant U.S. exposure.

Infosys fell 4.2 percent, TCS dropped 3.8 percent, and Wipro declined by 3.5 percent. Analysts believe the sentiment may remain weak in the short term until there’s clarity on visa processing timelines and cost implications.

Broader Market Trends

- Banking and Auto stocks showed resilience, with ICICI Bank and Bajaj Auto posting modest gains.

- Pharma and FMCG sectors remained flat, offering little support to the falling indices.

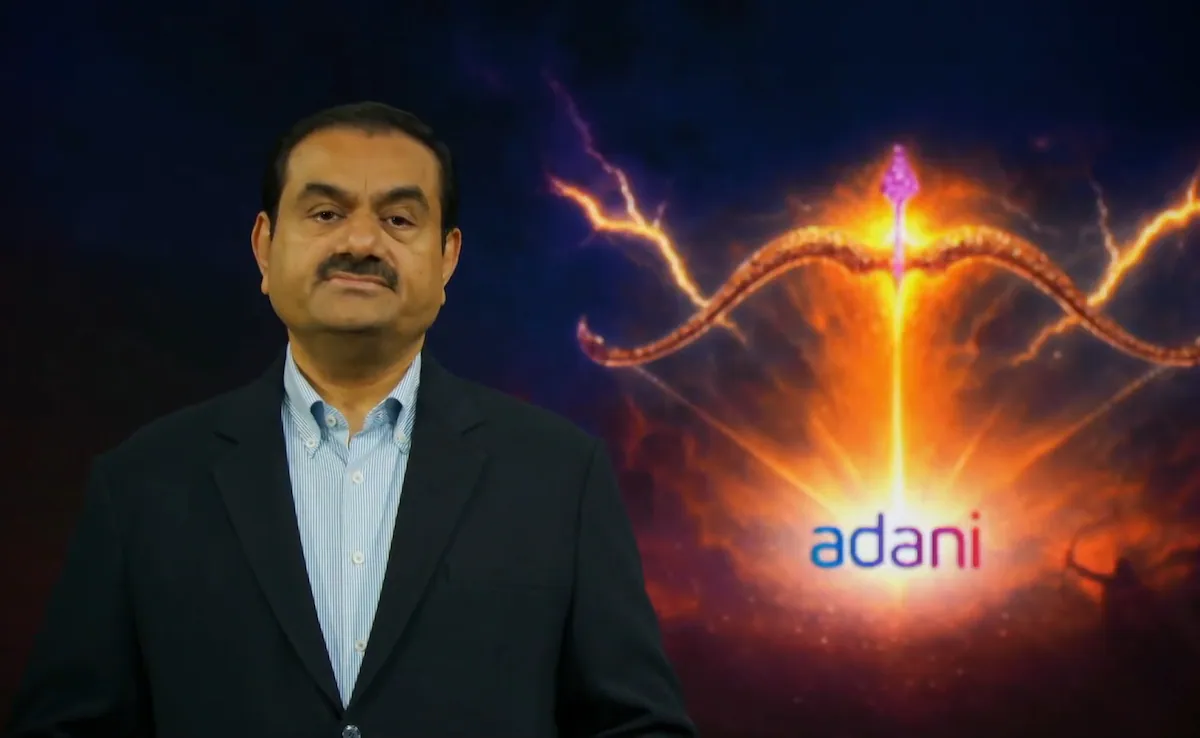

- Adani Group stocks continued their upward momentum, with Adani Power hitting a 15-month high post its stock split.

Global Cues and FII Activity

Global markets were mixed, with U.S. futures trading flat and European indices showing mild gains. Foreign Institutional Investors (FIIs) turned net sellers, offloading ₹1,200 crore worth of equities, while Domestic Institutional Investors (DIIs) provided some cushion with ₹950 crore in net buying.

Technical View

The Nifty has broken below its immediate support of 25,300, and analysts expect further downside toward 25,000 if selling persists. The index formed a bearish candle on the daily chart, indicating weakness. Traders are advised to remain cautious and avoid aggressive long positions until stability returns.

Strategic Insight for Traders and Investors

With volatility rising and sector-specific risks emerging, traders need to be selective and disciplined. IT stocks may remain under pressure, while defensive sectors like pharma and FMCG could offer safer bets in the near term.

For those seeking expert guidance in navigating such volatile conditions, the Best SEBI Registered Eqwires Research Analyst in India offers precision-driven strategies across stock options, intraday setups, and equity picks. Recognized as one of the best option trades providers, Eqwires delivers actionable insights tailored to market conditions.

Whether you’re exploring best options trading strategies, stock options, or looking for reliable advice from the best equity tips provider, Eqwires stands out as the best intraday tips provider, best stock market tips provider, and best stock market company in India for traders who value research-backed decisions and consistent performance.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555