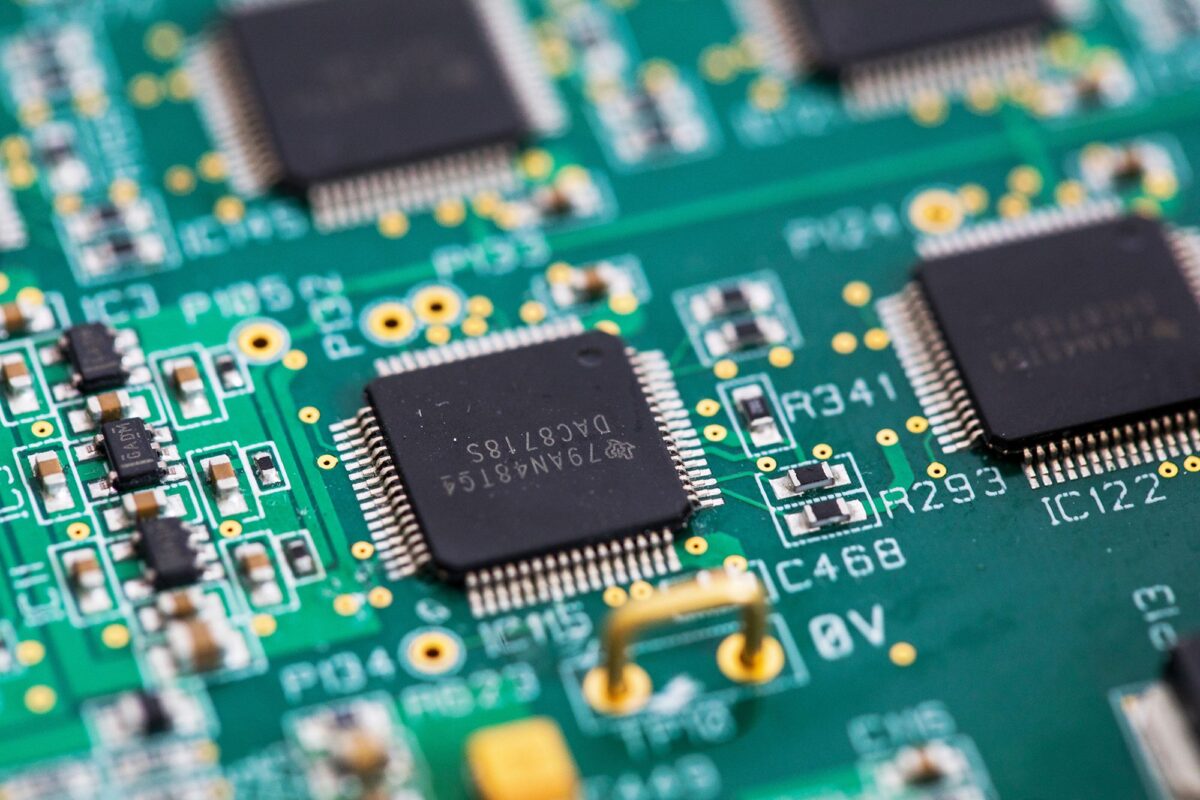

In a sweeping move that could reshape the global tech supply chain, President Donald Trump has announced a 100% tariff on imported computer chips and semiconductors, unless they’re manufactured within the United States. The policy, set to take effect in 21 days, is already sending shockwaves through the electronics industry and raising concerns about rising consumer prices.

What the Tariff Means

Trump’s announcement, made during a press briefing with Apple CEO Tim Cook, is part of a broader strategy to force tech companies to localize production. The tariff applies to:

- Imported chips and semiconductors from countries like China, Taiwan, South Korea, and India

- Electronics, appliances, and vehicles that rely on foreign-made chips

However, companies that manufacture chips in the U.S. will be exempt from the tariff. Trump emphasized, “If you’re building in the United States of America, there’s no charge.”

Impact on Electronics Prices

The ripple effects could be significant:

- Smartphones and laptops may see price hikes of 10–25% depending on chip origin

- Automobiles, already hit by chip shortages during the pandemic, could become costlier

- Home appliances like refrigerators, washing machines, and smart TVs may also be affected

Industry analysts warn that corporate profit margins will be squeezed, and many companies may pass the cost on to consumers.

Winners and Losers

Likely Beneficiaries:

- Apple, which recently pledged an additional $100 billion investment in U.S. manufacturing, bringing its total to $600 billion

- Nvidia and Intel, both expanding domestic chip operations

- U.S.-based suppliers like GlobalFoundries, Texas Instruments, and Corning

At Risk:

- Companies heavily reliant on Asian supply chains, including budget electronics brands

- Indian and Chinese manufacturers, facing compounded tariffs due to geopolitical tensions

Strategic Shift from Incentives to Pressure

Trump’s approach marks a departure from the CHIPS and Science Act signed in 2022 under President Biden, which offered $50 billion in subsidies and tax credits to encourage domestic chip production. Instead of incentives, Trump is using tariffs as leverage, betting that higher costs will compel companies to relocate manufacturing.

Global Context and Market Reaction

- Chip demand is surging, with global sales up 19.6% year-over-year as of June

- Wall Street responded positively to the exemption clause: Apple shares rose 5% in regular trading and another 3% after-hours

- India and Russia are negotiating separately over a new 25% tariff on Indian goods linked to oil trade

What Comes Next?

With the tariff clock ticking, companies have three weeks to adjust supply chains or face steep import duties. Consumers should brace for potential price hikes, especially on tech products launching in the fall. Meanwhile, the administration is expected to release further guidance on exemptions and enforcement.

Final Thoughts

Trump’s 100% chip tariff is more than a trade policy—it’s a bold bet on reshoring America’s tech backbone. Whether it leads to a renaissance in U.S. manufacturing or a spike in consumer costs remains to be seen. But one thing is clear: the global electronics landscape is about to change.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555