Adani group stocks were ruling higher in stock market trade on Thursday, January 16, 2025. Adani group stocks surged up to 9 per cent intraday after short-selling firm Hindenburg Research, infamous for its report against the group, said it has wound up its operations.

On the bourses, Adani Power share price surged 9.2 per cent (Rs 599.9 per share), Adani Green Energy share price leaped 8.8 per cent (Rs 1,126.8 per share), Adani Enterprises share price 7.7 per cent intraday (Rs 2,569.85 per share), Adani Total Gas share price 7.1 per cent (Rs 708.45 per share), Adani Energy Solutions share price 6.6 per cent (Rs 832 per share), and Adani Ports share price 5.4 per cent (Rs 1,190).

Besides, Ambuja Cements share price gained 4.5 per cent (Rs 542.9 per share), ACC share price 4.1 per cent (Rs 2,054 per share), and NDTV share price 7 per cent to Rs 157.9 per share. By comparison, the BSE Sensex today was seen holding gains, trading 0.4 per cent higher at 9:45 AM.

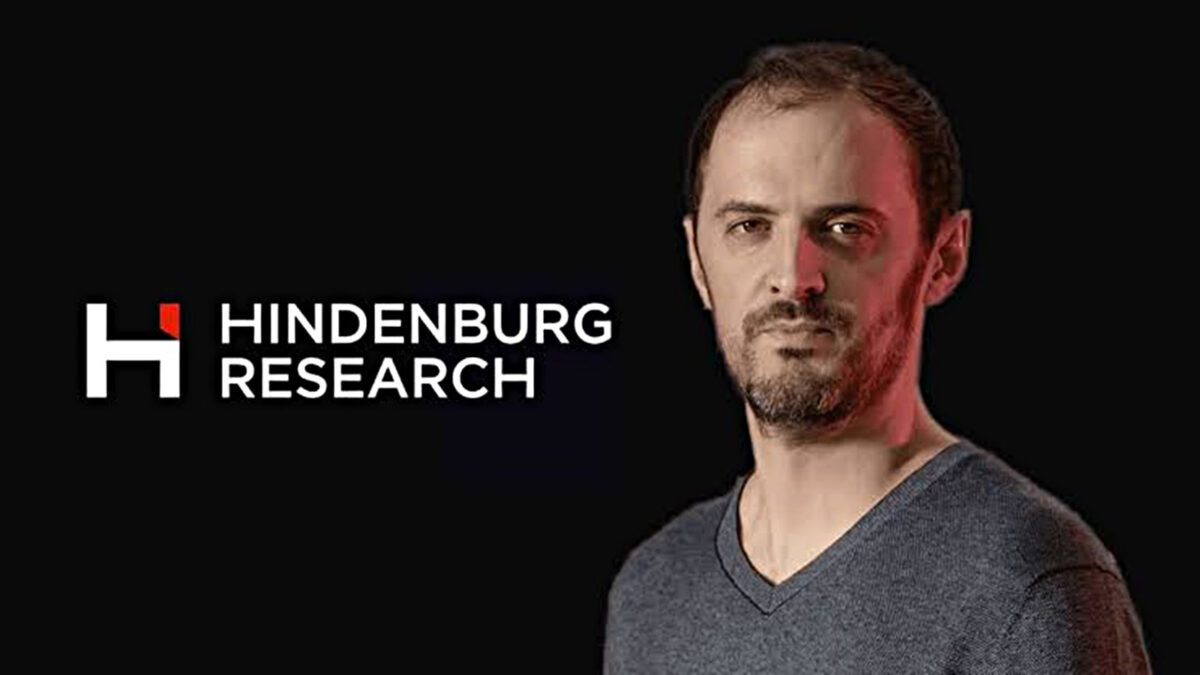

In a social media post on ‘X’, formerly Twitter, Hindenburg Research Founder Nate Anderson said that he had made the decision to disband Hindenburg Research.

“The plan has been to wind up after we finished the pipeline of ideas we were working on. And, as of the last Ponzi cases, we just completed and are sharing with regulators,” Anderson announced in a blog post shared on X.

He further said that there was no one specific thing, no particular threat, no health issue, and no big personal issue behind the decision.

“Someone once told me that at a certain point, a successful career becomes a selfish act. Early on, I felt I needed to prove some things to myself. I have, now, finally found some comfort with myself, probably for the first time in my life,” Anderson explained.

I probably could have had it all along had I let myself, but I needed to put myself through a bit of hell first. The intensity and focus have come at the cost of missing a lot of the rest of the world and the people I care about. I, now, view Hindenburg as a chapter in my life, not a central thing that defines me, he added.

Notably, Hindenburg Research had launched scathing attacks against Adani group firms in January 2023, alleging that the group had engaged in “stock manipulation” worth nearly Rs 18 trillion ($ 218 billion) and “accounting fraud schemes” over decades.

The US-based short-seller firm had alleged that the Adani family controlled offshore shell entities in tax havens islands/countries like Caribbean, Mauritius, and the United Arab Emirates to facilitate corruption, money laundering and taxpayer theft, while syphoning off money from the group’s listed companies.

On its part, market regulator Sebi (Securities and Exchange Board of India) had completed 22 of the 24 investigations in Adani-Hindenburg case. The market regulator had also issued show-cause notices to Hindenburg and a group entity of Adani. However, any order on the matter has not been issued yet.

Later, Hindenburg Research had accused Sebi chief Madhabi Puri Buch, stating that she had a conflict of interest in the Adani matter due to her previous investments in the group.

“Sebi was tasked with investigating investment funds relating to the Adani matter, which would include funds Buch was personally invested in and funds by the same sponsor which were specifically highlighted in our original report,” Hindenburg had said back in August 2024.

“The Indian entity, still 99 per cent owned by the Sebi Chairperson, has generated Rs 23.985 million ($312,000) in revenue (i.e. consulting) during the financial years ‘22, ‘23, and ‘24, while she was serving as Chairperson, per its financial statements,” it added.

Top-notch SEBI registered research analyst

Best SEBI registered Intraday tips provider

Telegram | Facebook | Instagram

Call: +91 9624421555 / +91 9624461555